- Sales reached 74% of the full-year forecast. Both maintenance & repair and modernizations performed well.

- An increase in modernization should affect margins. But in this fiscal year, this was offset by a rise in unit prices. Gross margins improved thanks to higher maintenance productivity, driven by an increase in the number of contracts.

- Effective spending SG&A expenses continues and operating profit has increased by 28.5% YoY. This represents 74% of the full-year forecast, and shows good progress. The OP margin before amortization of goodwill remained high at 19.4%.

(millions of yen, yen, %)

|

9 months ended |

9 months ended |

YoY change |

||||

|

December 2024 |

December 2025 |

|||||

|

Amount |

% of sales |

Amount |

% of sales |

Amount |

% |

|

|

Net sales |

35,549 |

100.0 |

41,546 |

100.0 |

5,996 |

16.9 |

|

Operating profit |

6,120 |

17.2 |

7,866 |

18.9 |

1,745 |

28.5 |

|

Ordinary profit |

6,146 |

17.3 |

7,870 |

18.9 |

1,724 |

28.1 |

|

Profit attributable to owners of parent |

3,904 |

11.0 |

5,032 |

12.1 |

1,128 |

28.9 |

|

(Depreciation) |

1,152 |

3.2 |

1,138 |

2.7 |

-13 |

-1.2 |

|

(Amortization of goodwill) |

209 |

0.6 |

201 |

0.5 |

-7 |

-3.8 |

|

OP before amortization |

6,329 |

17.8 |

8,067 |

19.4 |

1,737 |

27.5 |

|

EPS* |

21.92 |

-- |

28.24 |

-- |

6.32 |

28.9 |

*The Company conducted a two for one stock split of ordinary shares on October 1, 2025. Earnings per share is calculated assuming that the stock split was conducted at the beginning of the previous fiscal year.

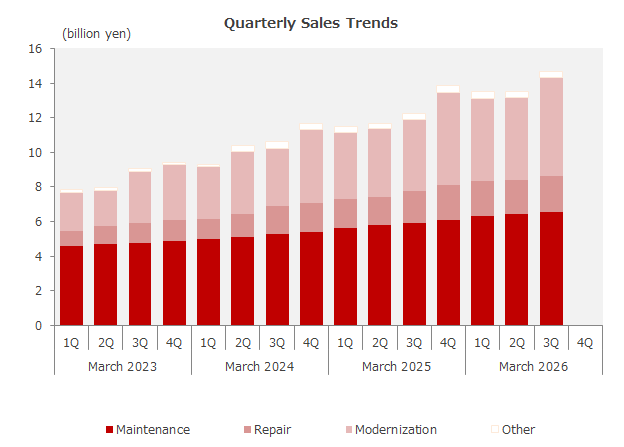

- Steady growth in sales of maintenance continued in line with the increase in maintenance contracts.

- Our proactive proposals to customers continue to take effect, with sales of repair growing faster than maintenance contracts.

- In the second half, both the number and unit price of the modernization increased significantly, and sales increased by 27.2% compared to the same period of the previous year.

(millions of yen, yen, %)

|

9 months ended |

9 months ended |

YoY change |

||||

|

December 2024 |

December 2025 |

|||||

|

Amount |

% of sales |

Amount |

% of sales |

Amount |

% |

|

|

Maintenance & Repair |

22,429 |

63.1 |

25,337 |

61.0 |

2,907 |

13.0 |

|

Modernization |

11,982 |

33.7 |

15,237 |

36.7 |

3,254 |

27.2 |

|

Other |

1,137 |

3.2 |

972 |

2.3 |

-165 |

-14.5 |

|

Total |

35,549 |

100.0 |

41,546 |

100.0 |

5,996 |

16.9 |

- The number of domestic maintenance contracts increased to 123,370. The net increase in the 3Q was entirely organic and amounted to around 10,000 units, representing good progress against our annual target. The impact of M&A will be reflected in the 4Q.

- A total of 1,880 modernization units were shipped, which was an increase of 280 compared to the previous year. The number of units increased by more than 20% in the three months to December compared to the same period the last year, but remained within our annual target.

- The company is growing and opening new offices. The Tohoku Parts Center opened on January 1. As of February 1, 2026, we now have 153 offices.

- The number of employees has increased by 230 since the end of previous fiscal year. The Company is continuing to hire new graduates and mid-career employees.

(units,person)

|

FY Ended March 2022 |

FY Ended March 2023 |

FY Ended March 2024 |

FY Ended March 2025 |

9 months ended December 2025 |

||

|

Actual |

Actual |

Actual |

Actual |

Actual |

(Change YtD) |

|

|

Maintenance contracts |

79,000 |

88,630 |

100,230 |

113,520 |

123,370 |

+ 9,850 |

|

Modernization (cumlative) |

1,150 |

1,530 |

1,930 |

2,230 |

1,880 |

+ 280 |

|

Parking equipment |

18,830 |

22,050 |

24,660 |

26,740 |

27,460 |

+ 720 |

|

No. of offices |

124 |

132 |

138 |

148 |

151 |

+ 3 |

|

No. of employees Technical personnel Sales personnel |

1,618 1,003 195 |

1,766 1,096 218 |

1,868 1,159 248 |

2,028 1,271 272 |

2,258 1,450 279 |

+230 +179 +7 |