The number of elevators operating in Japan (including elevators, escalators, and small freight elevators, etc.; hereinafter collectively referred to as "elevators") had reached 1.1 million as of March 31, 2025, growing at around 1-2% per year against a backdrop of moderate economic growth and urbanization, even as the total population declines.

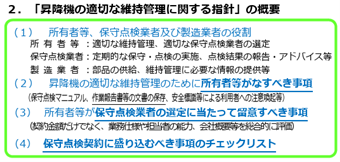

The Building Standards Act imposes management responsibility on building owners and managers to "endeavor to maintain building facilities, including elevators, in a legally adequate state at all times," and requires statutory inspections at least once a year. In addition, the Ministry of Land, Infrastructure, Transport and Tourism, the competent ministry, has established 'Guidelines for the Appropriate Maintenance and Management of Elevators' and requires the periodic maintenance and inspection of elevators, taking into account factors including, but not limited to, frequency of use.

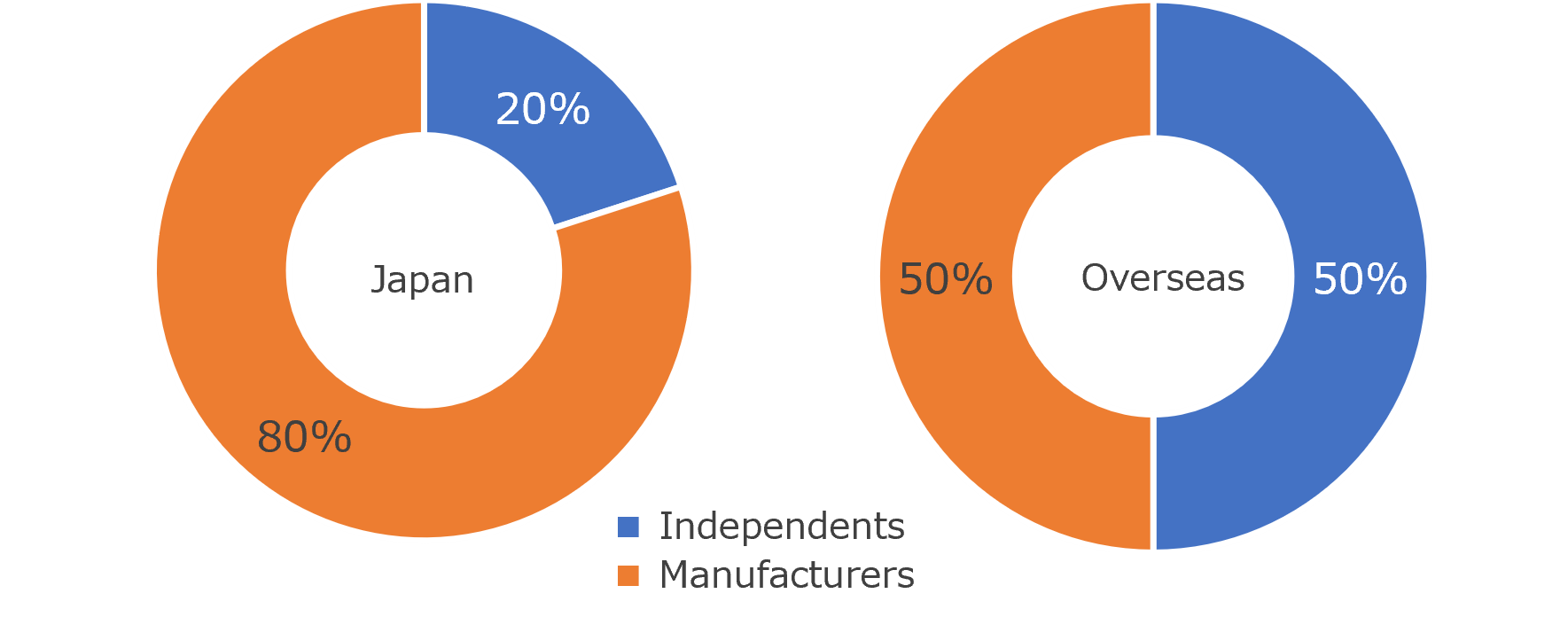

In Japan, it is common for a manufacturer to install an elevator and then have a manufacturer-affiliated company perform the maintenance. We estimate that these companies still hold approximately 80% of the elevator maintenance market. Overseas, the market shares of manufacturer-affiliated maintenance companies and independent maintenance companies are said to be closely matched.

Essentially, independent maintenance companies have the advantage of being able to provide services at lower rates than manufacturer-affiliated maintenance companies because they do not have the manufacturing process of elevators and therefore have a lower cost burden. Nevertheless, the market share of independent maintenance companies in Japan is lower than that of overseas markets because independent maintenance companies have historically been unable to bridge the gap with manufacturer-affiliated maintenance companies in terms of service quality, despite the market characteristics that emphasize safe elevator operation. This is thought to be due to the historical background. Below is a description of the changes in the market environment based on this background.

Comparison of Share of Manufacturers and Independent Companies in the Elevator Maintenance Market (Estimate)

The rapid increase in the number of elevators during Japan's period of high economic growth, coupled with the mandatory maintenance of elevators, led to many new elevator manufacturers and numerous independent maintenance companies entering the market. Elevator manufacturers have developed a competitive business model that recoups the costs of developing and manufacturing elevators through maintenance. Independent maintenance companies, who are new to the market, have found it difficult to obtain genuine maintenance parts. Later, several independent maintenance companies filed a lawsuit in 1985, claiming that the manufacturer's refusal to sell parts constituted a violation of the Antimonopoly Law, and in July 1993, the independent companies won their case in the Osaka High Court. It took some time for the intent of the ruling to permeate business practices. This is evidenced by the Fair Trade Commission's 2002 recommendation to a manufacturer. However, by the 2000s, the business environment had normalised, enabling independent maintenance companies to procure genuine parts from manufacturers and perform maintenance. Our company was established in October 1994. It could be said that we have risen to the challenge of changes in the industry's structure.

- 拡大

- (Source) Ministry of Land, Infrastructure, Transport and Tourism

In June 2006, an accident occurred in an elevator installed in a public rental housing complex in Tokyo, in which the cage of the elevator rose while the doors were open, and a passenger was caught in the elevator and killed.

Following this incident, the Ministry of Land, Infrastructure, Transport and Tourism revised the Building Standards Act in 2009 to make the installation of unintended car movement protection (UCMP) devices mandatory. In 2016, the 'Guidelines for the Appropriate Maintenance and Management of Elevators' were published to reaffirm the safety maintenance responsibilities of elevator owners and the obligation of manufacturers to disclose information to maintenance companies. The guidelines also include a clause stating that owners should not select a maintenance company based solely on price, but should ask companies to provide the necessary information and comprehensively evaluate the capabilities of their professional engineers, their track record in working with the same or similar types of elevators, and other factors affecting their performance. This effectively warned against choosing a maintenance company based solely on price.

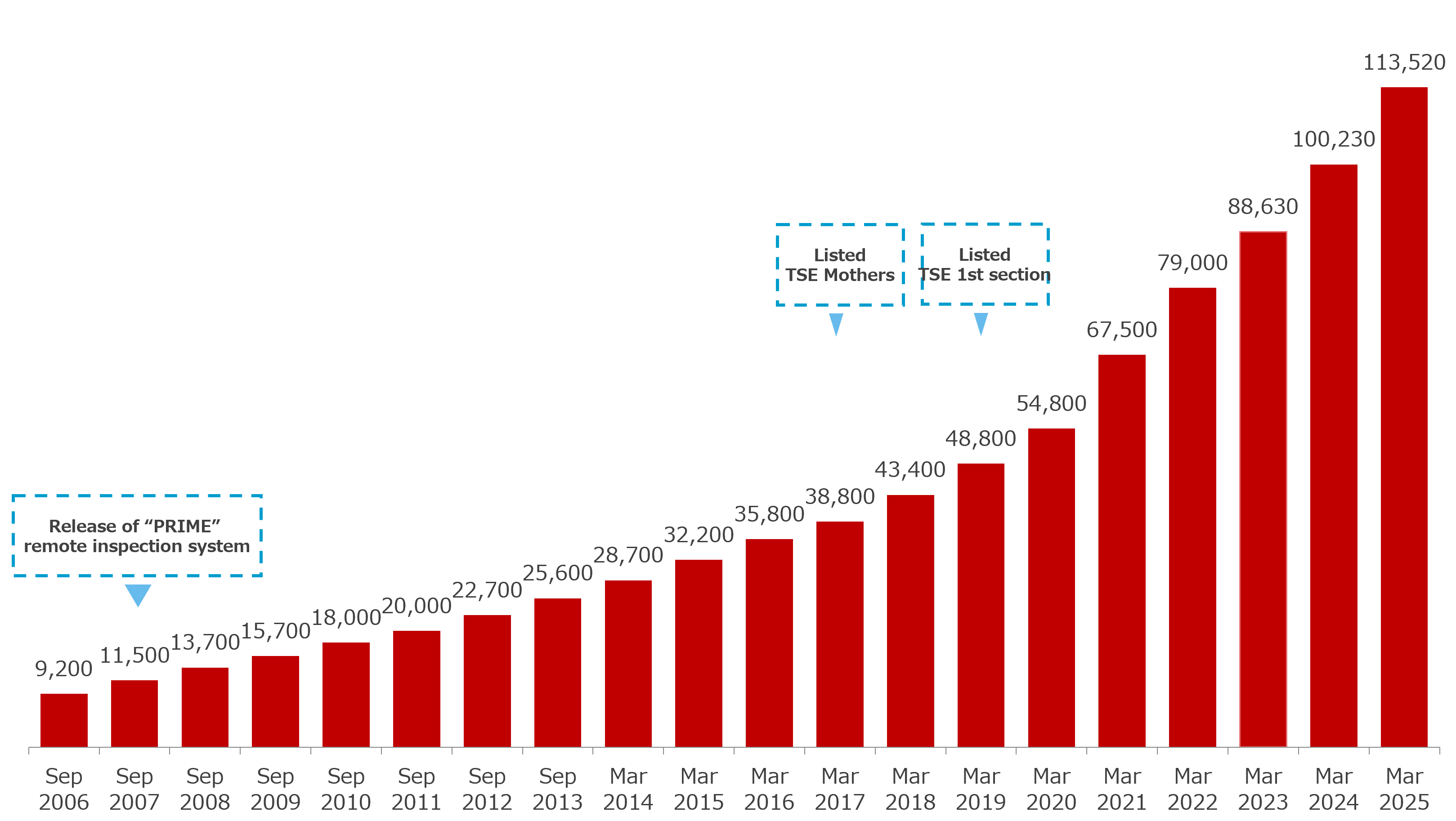

Since its establishment in 1994, the Company has aimed to provide quality services equivalent to those of manufacturers at reasonable prices. When manufacturers began introducing remote inspection systems in the 2000s, the Company was quick to commercialise its own patented remote inspection service "PRIME" in 2007. It has continued to invest in supporting its commitment to quality.

Amid ongoing concerns about the reliability of independent maintenance companies following the 2006 elevator accident, the Company listed its shares on the then Tokyo Stock Exchange Mothers on March 17, 2017 and changed its market listing to the First Section on the following September 10, 2018 (currently listed on the Tokyo Stock Exchange Prime Market).

At the same time, in order to consolidate functions such as parts centers, control centers, training centers, and R&D centers that had been dispersed in various locations, JES Innovation Center (JIC), equipped with a 50-meter-high (equivalent to 15-story) test tower, was completed on October 13, 2017 in Wako, Saitama, the first time for an independent maintenance company.

|

Remote Inspection Service "PRIME" |

|

JES Innovation Center (JIC) |

Although the Company is an independent maintenance company, it has facilities comparable to those of manufacturers and has gained credibility as a company listed on the First Section of the Tokyo Stock Exchange. Our system of providing high-quality services at reasonable prices has become widely recognized, and the number of maintenance contracts is rapidly expanding. At the time of the 'PRIME' launch, we had a maintenance contract for just over 10,000 units. It then took us around 12 years to exceed 50,000 units by the end of June 2019. Following our listing, however, we surpassed 100,000 units in just five years, by the end of March 2024. Yet our market share expansion has only just begun, and we believe we can catch up with overseas markets in the future.

Trends in JES Group's Domestic Maintenance Contracts (units)

The legal useful life of an elevator is 17 years, but this is the number of years specified to calculate depreciation for tax purposes, and the elevator can be used beyond that if it is maintained through proper maintenance and inspections. In fact, the Building and Equipment Long-life Cycle Association sets 25 to 30 years as the standard for elevator renewal cycles, and condominiums and other buildings use this as the basis for their repair budget plans. In addition to renewal demand due to age, elevator manufacturers may stop supplying maintenance parts as early as 20 years after the elevator stops being manufactured. Recently major manufacturers have announced that they are suspending the supply of maintenance parts for elevators manufactured and installed between 1980 and 2000.

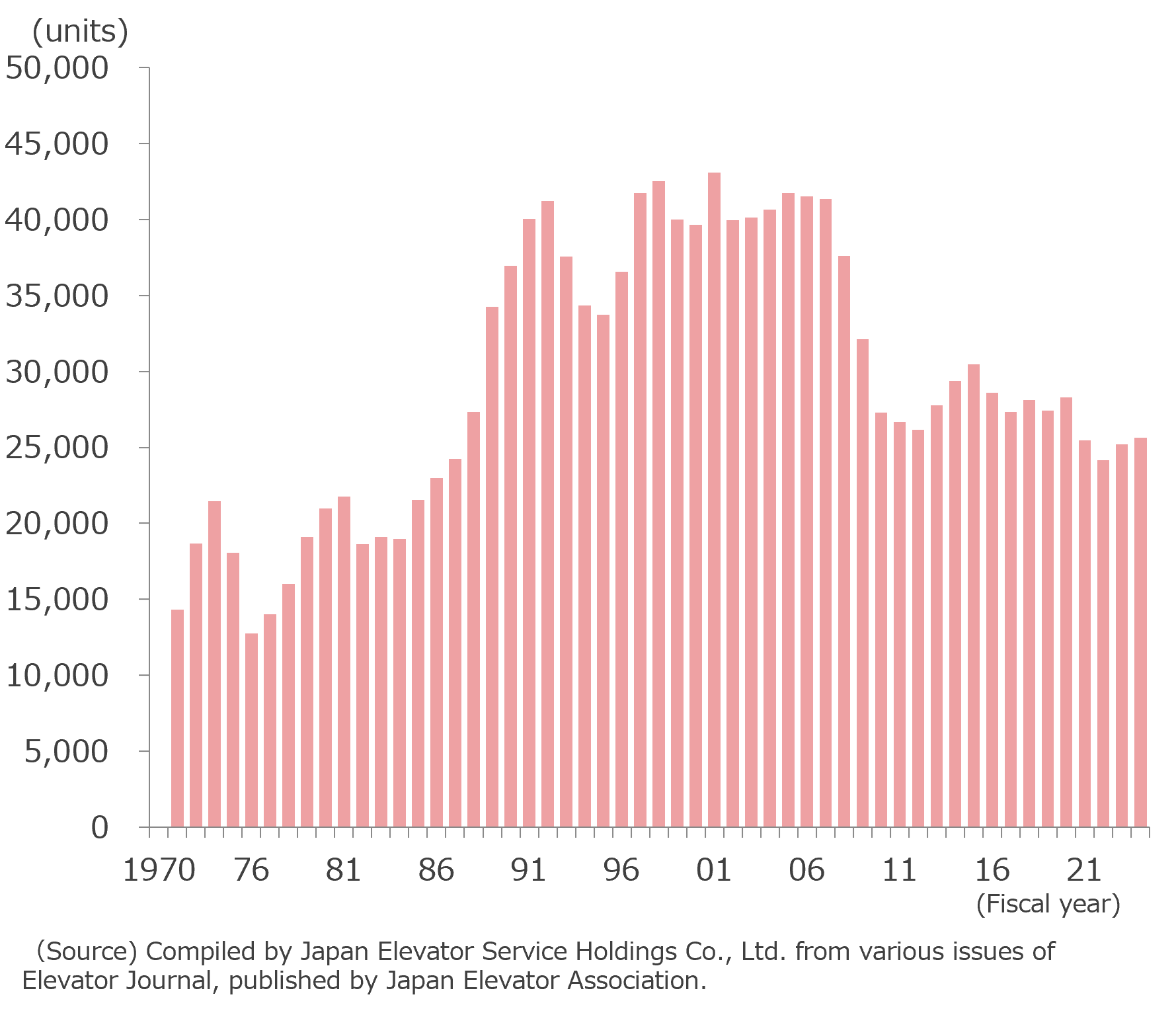

The 1980s marked the era when inverter control of elevators became widespread. Since these semiconductor devices cannot be replaced by general-purpose products, it will be difficult to continue maintenance of the subject elevators once the distribution inventory of maintenance parts runs out. As a result, elevator owners are faced with the choice of removing all existing elevators and replacing them with new ones, or modernize them (at a minimum, replacing only the control panel where the inverter is housed and core components such as the hoisting motor). Looking at the trend in the number of new elevators installed in Japan, it can be inferred that there are many elevators due for replacement, and strong demand for modernization is expected to continue.

To meet this demand, the JES Group is expanding its supply capacity by completing construction of JES Innovation Center Kansai (JIK) in Takarazuka City, Hyogo in March 2024, in addition to JIC in Wako.

Number of New Elevators Installed in Japan

JES Innovation Center Kansai (JIK)

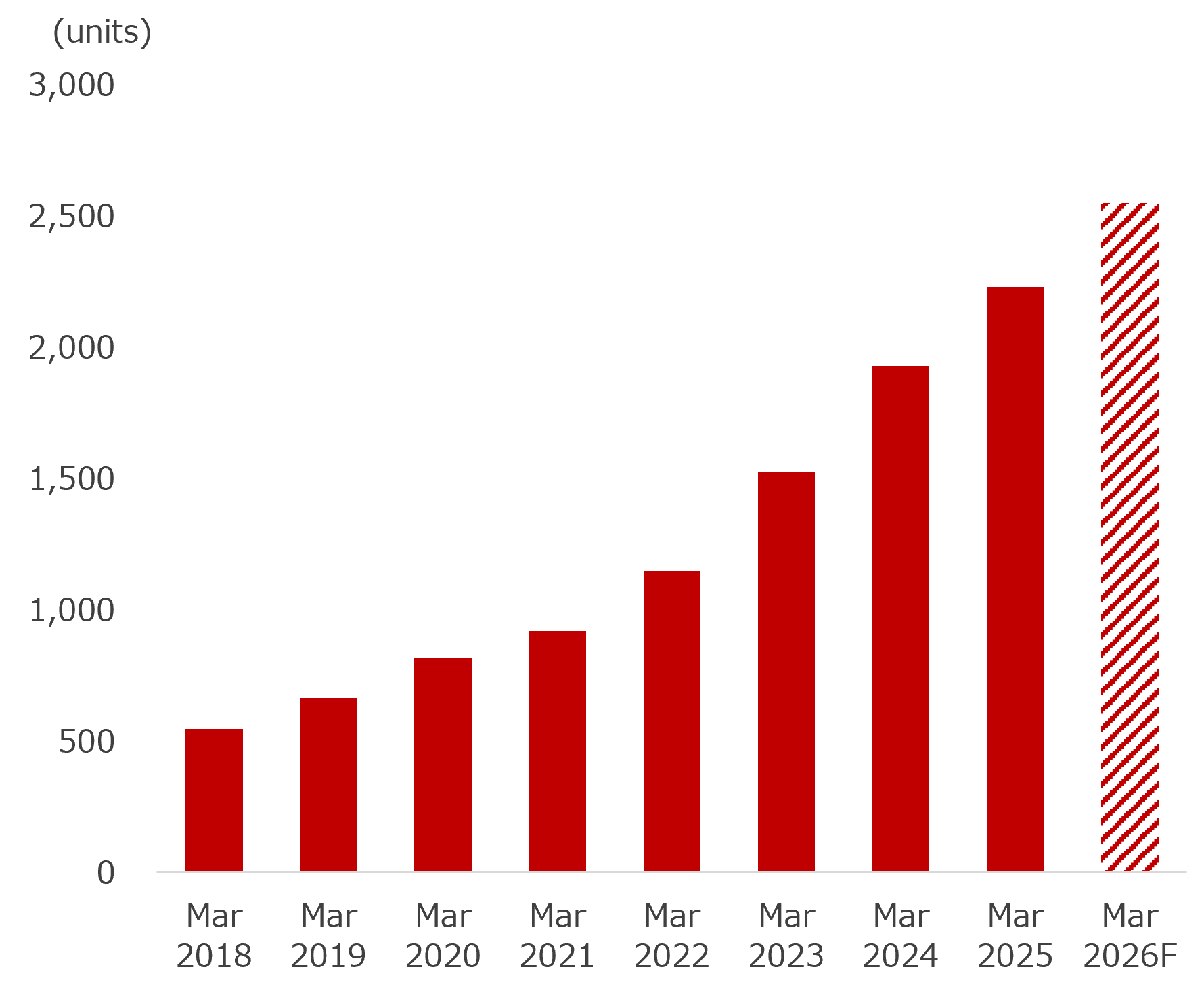

Trends in Modernization Shipment by JES Group