- In the maintenance & repair, net growth in the number of maintenance contracts is expected to continue, and in the modernization, growth in the number of shipments and unit price is expected.

- In addition to productivity improvements due to the increase in the number of contracts, the company expects to continue to control SG&A and achieve an OP margin before amortization of over 19%. As a result, both sales and profits are expected to reach new highs.

(millions of yen, %)

|

March 2025 |

March 2026 Forecast |

||||

|

Amount |

% of sales |

Amount |

% of sales |

YoY |

|

|

Net sales |

49,375 |

56,500 |

114.4 |

||

|

Operating profit |

8,624 |

17.5 |

10,600 |

18.8 |

122.9 |

|

Ordinary profit |

8,621 |

17.5 |

10,600 |

18.8 |

123.0 |

|

Profit attributable to owners of parent |

5,530 |

11.2 |

6,600 |

11.7 |

119.3 |

|

(Depreciation) |

1,562 |

3.2 |

1,500 |

2.7 |

96.0 |

|

(Amortization of goodwill) |

276 |

0.6 |

267 |

0.5 |

96.9 |

|

OP before amortization |

8,900 |

18.0 |

10,867 |

19.2 |

122.1 |

(millions of yen, %)

|

March 2025 |

March 2026 Forecast |

||||

|

Amount |

% of sales |

Amount |

% of sales |

YoY |

|

|

Maintenance & repair services |

30,538 |

61.8 |

33,600 |

59.5 |

110.0 |

|

Modernization services |

17,325 |

35.1 |

21,500 |

38.1 |

124.1 |

|

Other |

1,511 |

3.1 |

1,400 |

2.5 |

92.7 |

|

Net Sales |

49,375 |

100.0 |

56,500 |

100.0 |

114.4 |

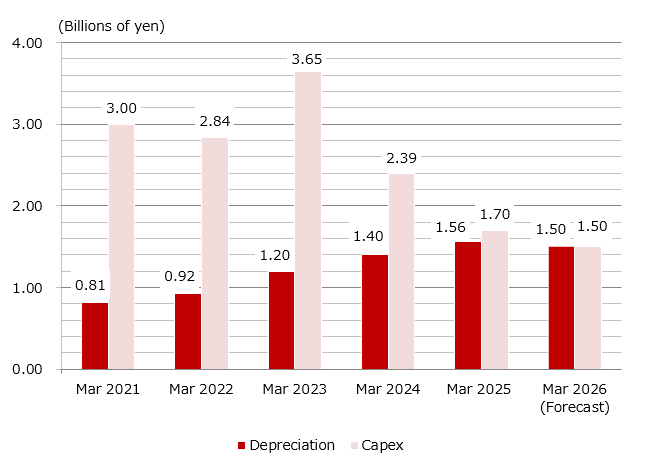

(billions of yen)

|

FY2025 (Actual) |

FY2026 (Forecast) |

Items |

|

|

Capital Expenditures |

1.70 |

1.50 |

Investments related to PRIME, a remote inspection service, etc. |

|

Depreciation |

1.56 |

1.50 |

Trends in Capital Expenditures and Depreciation

Disclosed on November 13, 2025