Medium-Term Management Plan

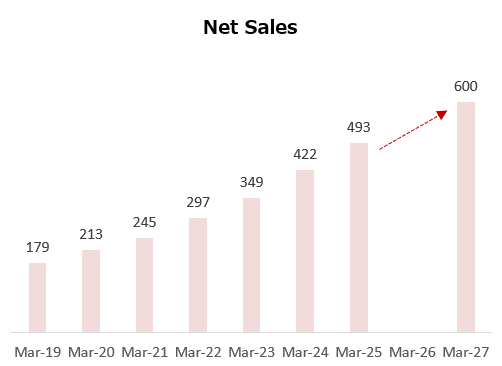

Japan Elevator Service Holdings (hereinafter referred to as "the Company") has summarized its goals to be achieved over the five years from the fiscal year ending March 31, 2023 to the fiscal year ending March 31, 2027 as "VISION2027" and disclosed them on May 18, 2022.

Since our founding in 1994, we have worked to strengthen our system to provide elevator manufacturers with the same level of maintenane and repair service quality at a price that only an independent maintenance company can offer. As a result, the company has achieved high growth to the point where it now holds the top position among independent maintenance companies in Japan.

We will continue to strengthen our system and quality to promptly provide safe and reliable maintenane, repair and modernization services to our customers nationwide, and aim to increase the number of maintenance contracts. In addition to business growth, we will also take social issues and global environmental issues seriously, as befits a company listed on the Tokyo Stock Exchange Prime Market, and aim for sustainable growth and increased corporate value in order to coexist with all of our stakeholders.

-

Medium-Term Plan “VISION 2027”

(712KB)

Medium-Term Plan “VISION 2027”

(712KB)

- Expand market share of maintenance contracts in newly expanded areas, particularly in western Japan,

- Construction of Kansai JIC to supply parts and respond to modernization in new business areas (completed in March 2024),

- Visualize customer information through the use of DX to improve the ability to make proposals in each phase of maintenance, repair, and modernization,

- Capturing new growth opportunities through modernization (quick renewal),

- Human resource development and improvement of service capabilities through in-house training programs,

- Organic growth is the principle, but M&A opportunities will also be utilized, and

- Expand media business and overseas business

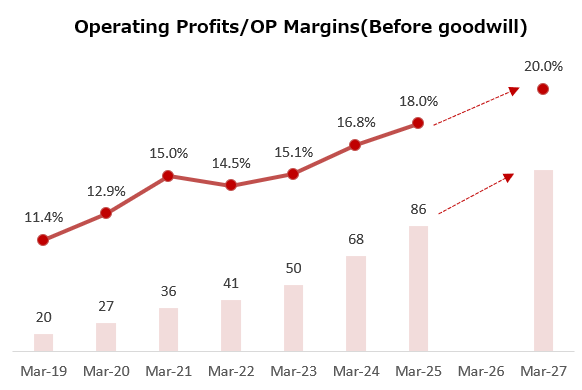

- Increased profit margin due to economies of scale resulting from increased number of maintenance contracts,

- Utilization of refurbished products to reduce variable costs and improve environmental friendliness, and

- By increasing the number of units under management, various procurement costs and indirect fixed costs could be reduced through the effect of economies of scale

- Maintain a dividend payout ratio of 40% or more and increase returns in line with profit growth,

- Creation of employment opportunities through active recruitment, especially of new graduates,

- Efforts to Address Human Rights Issues, and

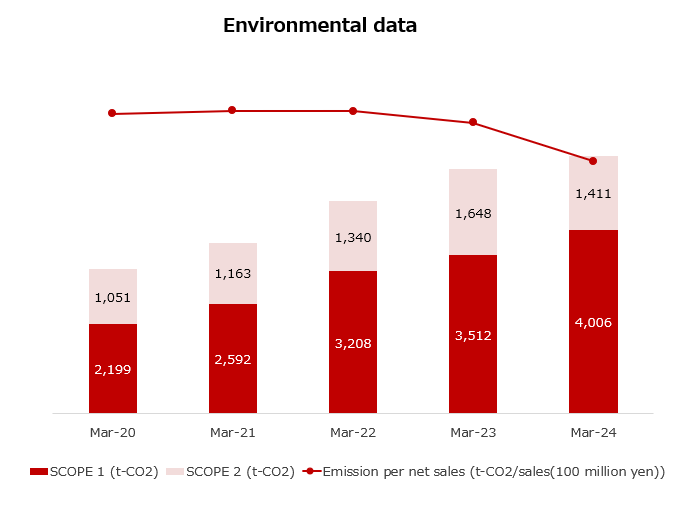

- Analyse GHG emissions, financial impacts and opportunities of global warming, and efforts to reduce emissions.