The Company recognizes that returning profits to shareholders is one of its most important management policies, and its basic policy is to continue to pay stable dividends to shareholders while securing the internal reserves necessary to strengthen the management base in response to changes in the business environment and for future business development.

Under the medium-term management plan "VISION2027," our basic policy is to maintain a dividend payout ratio of 40% or more, and we aim for a stable increase in dividends per share in line with business expansion (growth in earnings per share).

Dividend record date: March 31

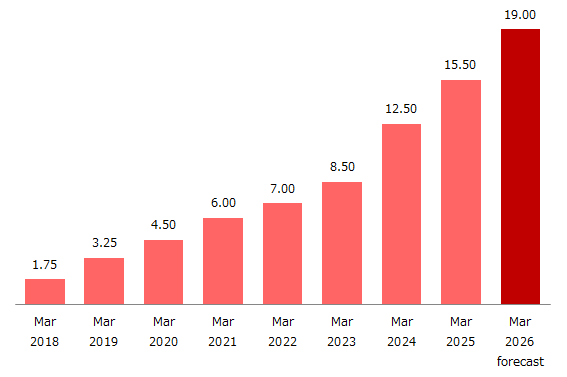

Adjusted Dividend Per Share (yen)

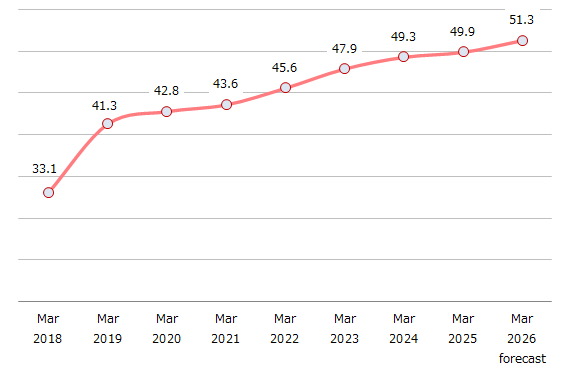

Dividend Payout Ratio (%)

|

FY Ended March 2022 |

FY Ended March 2023 |

FY Ended March 2024 |

FY Ended March 2025 |

FY Ending March 2026(forecast) |

|

|

Total dividends |

1,242 |

1,513 |

2,226 |

2,760 |

- |

|

Dividend per share (of which commemorative dividend) |

7.00 |

8.50 |

12.50 |

15.50 |

19.00 |

|

Dividend payout ratio |

45.6% |

47.9% |

49.3% |

49.9% |

- |

|

Dividend on equity |

11.3% |

12.0% |

14.8% |

15.1% |

- |

|

Total Shareholder Return (Reference: TOPIX) |

130.9% (145.0%) |

176.6% (153.4%) |

199.8% (216.8%) |

228.4% (213.4%) |

- |

The Company executed 2-for-1 stock splits of its common stock on October 1, 2017, on October 1, 2018, on January 1, 2021,and on October 1, 2025. Dividend per share amounts have been retroactively adjusted as if all stock splits had occurred at the beginning of the fiscal year ended March 31, 2017.