Basic Policy

- The Company shall strive to ensure that the rights of shareholders and the equality of shareholders are substantially secured.

- The Company shall strive to collaborate with various stakeholders appropriately, including employees, customers, suppliers, creditors, and local communities.

- The Company shall disclose corporate information in an appropriate manner and strive to provide information that is highly useful.

- The Board of Directors shall endeavor to properly fulfill its roles and responsibilities in light of its fiduciary responsibility and accountability to shareholders.

- The Company shall strive to engage in constructive dialogue with shareholders in order to contribute to the sustainable growth of the company and the enhancement of its corporate value over the medium to long term.

Governance is the Cornerstone of Sustainable Growth

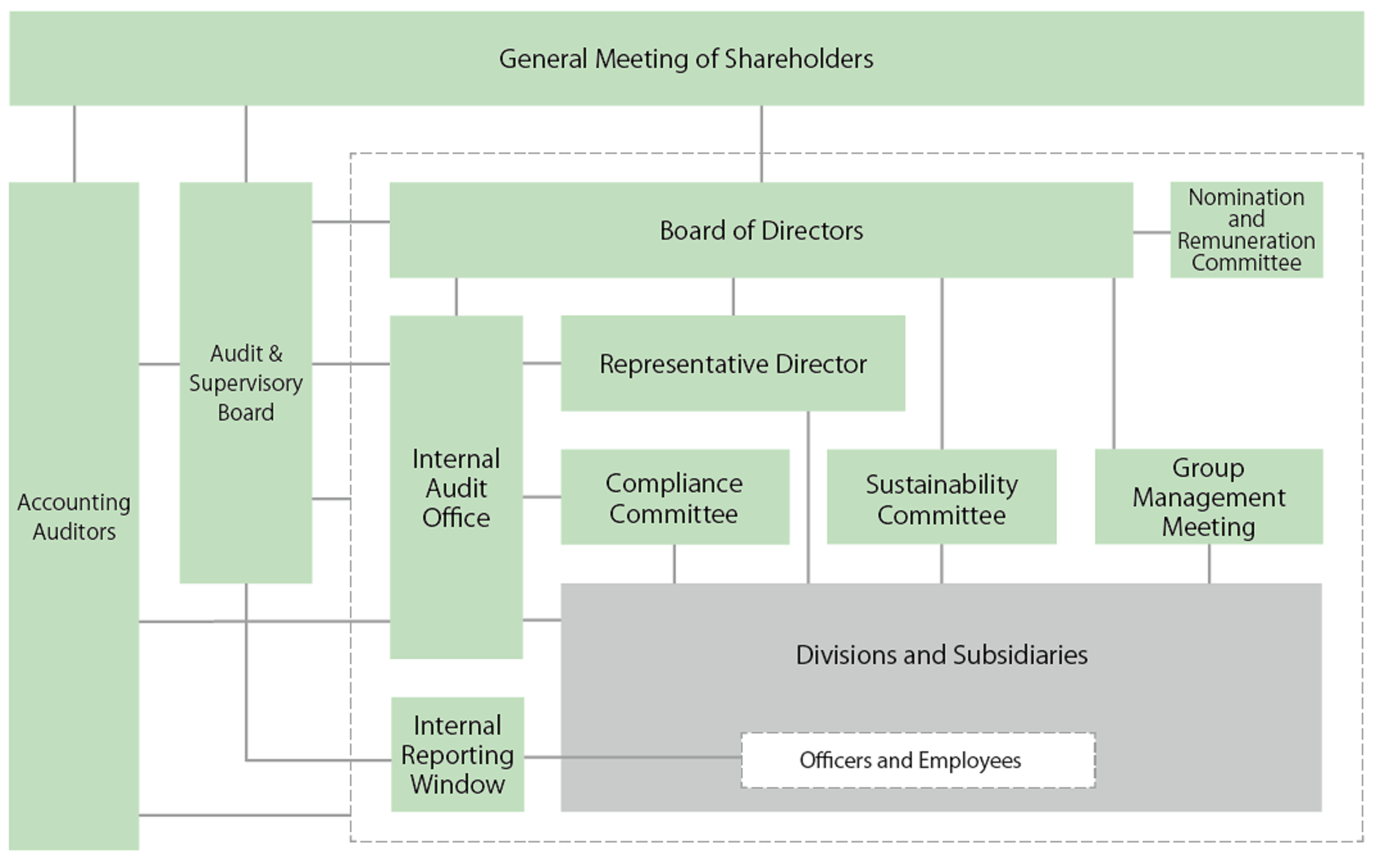

Stronger governance leads to greater transparency in organizational and corporate operations, greater responsibility as a publicly traded company, and greater business efficiency. Strengthening governance provides transparency to the corporate group's internal and external stakeholders. Transparency leads to better understanding of organizational processes and greater credibility for shareholders, customers, employees, and other stakeholders. By clarifying roles and responsibilities within the organization, it serves to monitor the process and clarify responsibilities when problems arise. Governance leads to risk management and compliance. It helps the corporate group to comply with laws and regulations, minimize risks, and reduce reputation risks due to violations of laws and regulations. From the above, governance leads to long-term profitability and competitiveness. It enhances the long-term sustainability and credibility of the company, thereby benefiting its various stakeholders.

The JES Group recognizes that strengthening corporate governance is one of the most important management issues in order to continuously increase corporate value and achieve management stability. We will place particular emphasis on strengthening oversight of management, ensuring compliance, and prompt, accurate, and fair disclosure of information to all stakeholders, and will further enhance these efforts.

The Board of Directors of JESHD consists of five directors (including three outside directors) and holds regular meetings once a month in principle for the purpose of making decisions on important matters related to the company's business operations, matters required by law, and other important management matters. The Board of Directors is chaired by Katsufumi Ishida, Representative Director and President CEO, and its other members are Kimihiko Imamura, Director Deputy President CFO, Hitoshi Watanabe, Outside Director, Noriko Endo, Outside Director, and Mika Yano, Outside Director. (As of June 24, 2025)

The Board of Directors, in accordance with the bylaws on matters to be discussed and reported to the Board of Directors, adopts resolutions on basic management policies, important business execution matters, matters authorized by resolution of the General Meeting of Shareholders, and other matters stipulated by laws, regulations, and the Articles of Incorporation, and also receives reports on matters stipulated by laws and regulations and the execution of important business operations. During the fiscal year ended March 31, 2025, the Company held 17 meetings of the Board of Directors, with an attendance rate of 100%.

As of June 24, 2025

|

Name |

Position and title in the Company |

Gender Male M/F |

Management |

Sales Marketing |

Human resources Labor Training |

Finance Accounting |

Legal Risk Management |

Sustainability |

|

Katsushi Ishida |

President & Representative Director CEO |

M |

〇 |

〇 |

〇 |

〇 |

||

|

Kimihiko Imamura |

Director, Deputy President CFO |

M |

〇 |

〇 |

〇 |

〇 |

〇 |

|

|

Hitoshi Watanabe |

Outside Director |

M |

〇 |

|||||

|

Noriko Endo |

Outside Director |

F |

〇 |

〇 |

〇 |

|||

|

Mika Yano |

Outside Director |

F |

〇 |

〇 |

〇 |

|||

|

Kei Tachibana |

Full-time Audit & Supervisory Board member |

M |

〇 |

〇 |

||||

|

Nobuyasu Ogata |

Outside Audit & Supervisory Board member |

M |

〇 |

〇 |

||||

|

Midori Mizutani |

Outside Audit & Supervisory Board member |

F |

〇 |

As of June 24, 2025

|

Name |

Position and title in the Company |

Number of Shares of the Company Held |

Reason for Appointment as Director or Auditor |

|

Katsushi Ishida |

President & Representative Director CEO |

19,033,700 |

He is the founder of the Company and has led the expansion of the Group's business through his excellent foresight, technical skills, and strong leadership as the Company's representative director for many years. We appointment him for director because of his extensive experience and broad knowledge in the elevator maintenance business and the industry in general, and because we expect him to contribute to the enhancement of the corporate value of our Group. |

|

Kimihiko Imamura |

Director, Deputy President CFO |

26,500 |

He has overseen the Company's administrative division after the Company's listing, utilizing his professional expertise as a certified public accountant. We appointment him for director because of his extensive knowledge and experience in the areas of business management, corporate governance, and finance, and we believe that he is well qualified to continue to enhance the corporate value of our group. |

|

Hitoshi Watanabe |

Outside Director |

- |

He has a high level of expertiseand a wealth of experience cultivated as a certified public accountant, and we appointment for Outside Director in the expectation that he will not only strengthen our overall management monitoring and supervision functions, but also apply his insight and knowledge, etc. to the overall management of the Company. |

|

Noriko Endo |

Outside Director |

3,000 |

We appointment for outside director in the expectation that she will not only strengthen the monitoring and supervision of overall management, but also apply her insight and knowledge to the overall management of the Company. |

|

Mika Yano |

Outside Director |

- |

She has extensive experience and insight in corporate legal affairs as a lawyer in the State of New York, U.S.A., as well as experience as a corporate manager. We expect that she will apply her wide range of experience and insight to the management of our Group, and appointment for Outside Director. |

|

Kei Tachibana |

Full-time Audit & Supervisory Board member |

9,400 |

He has business experience in the financial industry prior to joining the Company, and has been engaged as the head of the finance department since joining the Company, and has many years of experience and broad insight. Based on his work experience, heappointment for full-time Audit & Supervisory Board member because he is expected to contribute to the auditing of the Company's business execution. |

|

Nobuyasu Ogata |

Outside Audit & Supervisory Board member |

- |

He has opened a law firm and has many years of extensive knowledge in all aspects of law as an attorney-at-law. We believe that he will be able to use his expertise and knowledge to play a role in ensuring the adequacy and appropriateness of the Company's management in the future, and appointment for outside Audit & Supervisory Board member. |

|

Midori Mizutani |

Outside Audit & Supervisory Board member |

- |

She has sufficient knowledge of finance and accounting through her expertise and extensive experience as a certified public accountant. We believe that he will be able to use his expertise and knowledge to play a role in ensuring the adequacy and appropriateness of the Company's management in the future, and appointment for outside Audit & Supervisory Board member. |

The Audit & Supervisory Board meets once a month in principle, and when necessary, the Audit & Supervisory Board members hold discussions and exchange opinions with each other in order to ascertain the status of compliance by directors with laws, regulations, the Articles of Incorporation and other rules, and to ensure that operational and accounting audits are conducted effectively. The Audit & Supervisory Board is chaired by Kei Tachibana, a full-time Audit & Supervisory Board member, and its other members are Nobuyasu Ogata, an Outside Audit & Supervisory Board member, and Midori Mizutani, an Outside Audit & Supervisory Board member. (As of June 24, 2025)

In addition to attending meetings of the Board of Directors and other important meetings, Audit & Supervisory Board member conduct proper monitoring of management through inspection of important documents, questioning of officers and employees, and other auditing procedures. The Company also strives to conduct appropriate audits in cooperation with the Internal Audit Office and the accounting auditor.

Audit & Supervisory Board members strictly audit the overall operations of the Company and its subsidiaries in accordance with the audit plan, audit methods and work assignments determined by the Audit & Supervisory Board.

During the fiscal year ended March 31, 2025, the Company held 14 meetings of the Audit & Supervisory Boards, which were attended 100% of the time.

The Audit & Supervisory Board specifically considers audit items (compliance with laws and regulations, risk prevention, information security, and the status of establishment and operation of internal control systems) specified in the audit policy and plan, as well as evaluations of the accounting auditor's audit.

The full-time Audit & Supervisory Board member attends meetings of the Board of Directors and other important meetings, and conduct appropriate monitoring of management through auditing procedures such as inspection of important documents and questioning of officers and employees. The Company also strives to conduct appropriate audits in cooperation with the Internal Audit Office and the accounting auditor.

The Company has established the Nomination and Remuneration Committee as an advisory body to the Board of Directors in order to strengthen the independence, objectivity, and accountability of the Board of Directors in its functions related to the nomination and remuneration of senior management and directors. Currently, there are three committee members, a representative director and two outside directors, and the committee is chaired by an independent outside director. The independence of the committee is ensured by having a majority of the committee members be independent outside directors. The Committee shall deliberate on matters relating to the election and dismissal of directors and officers, as well as policies and procedures necessary to determine directors' remuneration, etc., and shall provide advice and recommendations to the Board of Directors.

The Nominating and Remuneration Committee held one meeting during the fiscal year under review with all three members in attendance. In addition, the Nominating and Remuneration Committee met to advise the Board on the election of directors, a resolution of the Company's Annual General Meeting of Shareholders to be held on June 24, 2025, with respect to nomination and remuneration.

The Company has established a Sustainability Committee directly under the Board of Directors with the aim of promoting sustainability initiatives linked to the management plan by resolving sustainability issues and identifying risks and opportunities, in order to achieve sustainable growth and increase corporate value over the medium to long term and the Committee is held once a month in principle, and whenever necessary. The Committee is chaired by Director, Deputy President CFO, and its members consist of personnel deemed appropriate for their duties in light of the purpose of the Committee. In addition to environment, social, governance and other issues related to sustainability, the board of directors confirms consistency with management and business, and manages and supervises measures.

An Internal Audit Office has been established under the direct control of the Representative Director. The Internal Audit Office, consisting of one person, audits all divisions of the Company and all subsidiaries for rationality, efficiency, appropriateness, and appropriateness of business execution in accordance with the annual internal audit plan. Audit results are reported to the Representative Director, who gives instructions for improvement to the person in charge of the audited department, and the status of improvement is monitored through follow-up audits, etc.

The Internal Audit Office regularly visits each subsidiary and office to interview employees regarding their work styles and work environment, and to identify issues. In addition, the Board of Directors is regularly informed of the status of activities and discusses improvement measures.

The Compliance Committee has been established as a body to ensure that compliance is adhered to in the Group. The Committee is composed of the director in charge, the general manager, the general manager of the Internal Audit Department, the full-time Audit & Supervisory Board member, the representative directors of subsidiaries, etc., and meets as necessary.

The Company has three outside directors and two outside Audit & Supervisory Board members. There is no personal, capital, business or other relationship of interest between the outside directors and outside corporate auditors and the JES.

All of the outside directors and outside corporate auditors are registered with the Tokyo Stock Exchange as independent directors/auditors with no possibility of conflicts of interest with general shareholders.

Although the Company has not established its own criteria for determining independence, the Company uses the fulfillment of the requirements for independent directors and auditors established by the Tokyo Stock Exchange as a standard as a guideline for the appointment of independent directors and auditors.

The percentage of female officers (directors and Audit & Supervisory Board members) is 37.5%.

The company has submitted an action plan based on the Law for the Promotion of Women's Advancement within the company, and will strive to increase the ratio of managerial positions from efforts in line with the plan. In addition, we will select personnel who will contribute to the growth of our business in terms of external appointments.

The Corporate Governance Code stipulates that "The board of directors should be proactively involved in the formulation and operation of succession planning (succession planning) for the CEO and other chief executive officers (CEOs), based on the company's goals (management philosophy, etc.) and specific management strategies, and should also appropriately supervise the training of potential successors in a planned manner, taking sufficient time and resources. In addition, the CEO should provide appropriate supervision to ensure that the development of potential successors is carried out in a planned manner with sufficient time and resources.

In order to achieve sustainable growth and increase corporate value over the medium to long term, we will devote sufficient time and resources to succession planning to ensure that the most suitable personnel are appointed to the CEO and key management positions supporting the CEO. At the same time, we will prepare for CEO contingencies and consider candidates for the next CEO.

Remuneration for Directors (excluding Outside Directors) Remuneration for Directors (excluding Outside Directors) consists of "base remuneration" and "non-monetary remuneration, etc.," which is intended to provide incentives to continuously improve the Company's corporate value and to promote further value sharing with shareholders.

The Company calculates the fixed remuneration of Directors within the limits of the remuneration for Directors approved at the above General Meeting of Shareholders, which is determined by the Representative Director with the discretion of the Board of Directors based on factors such as (1) duties in charge, (2) responsibilities, and (3) performance. Remuneration for Audit & Supervisory Board members is determined through discussions by the Audit & Supervisory Board within the limits of the remuneration for Audit & Supervisory Board members approved at the aforementioned General Meeting of Shareholders.

The remuneration of the Company's Directors (excluding Outside Directors) consists of "basic remuneration" as fixed remuneration and "non-monetary remuneration, etc." which is intended to provide incentives to continuously improve the Company's corporate value and to further promote value sharing with shareholders. Non-monetary compensation consists of shares with a restriction on transfer for a period of 35 years or less, and is granted to executive directors.

The maximum amount of remuneration for Directors was resolved at the 19th Annual General Meeting of Shareholders held on November 29, 2013 to be no more than 700 million yen per year. In addition, at the 24th Annual General Meeting of Shareholders held on June 26, 2018, as a separate line from the amount of remuneration, etc. for directors above, the Company resolved to set the amount of remuneration for the grant of restricted stock at no more than 350 million yen per year and the maximum number of shares at 680,000shares annually.

- Basic Policy

The Company's basic policy is to set the remuneration of individual directors at an appropriate level based on their respective responsibilities when determining their remuneration. Specifically, the remuneration for executive directors shall consist of base remuneration as fixed remuneration and stock-based remuneration, while outside directors, who are responsible for supervisory functions, shall be paid only base remuneration in light of their duties.

- Policy regarding the determination of the amount of compensation, etc. for each individual for basic compensation (monetary compensation) (including policy regarding the determination of the timing or conditions of granting compensation, etc.)

The basic remuneration of the Company's directors shall be a monthly fixed remuneration, which shall be determined in accordance with their position, responsibilities, and years in office, comprehensively taking into consideration the level of other companies, the Company's performance, and the level of employee salaries.

- Policy regarding the determination of the details of non-monetary compensation and the method of calculation of the amount or number of non-monetary compensation (including policy regarding the determination of the timing or conditions of granting compensation, etc.)

Non-monetary compensation shall be in the form of restricted stock with a restriction period of up to 35 years, and shall be granted at a time determined by a resolution of the Board of Directors to the executive directors determined by the same resolution. The grantee, the number of shares to be granted, and the timing of the grant shall be determined by comprehensively taking into consideration the position, responsibilities, the level of other companies, and the Company's business performance.

- Policy regarding the determination of the amount of monetary and non-monetary compensation as a percentage of the amount of compensation, etc., paid to each individual director

The ratio of remuneration for each type of executive director shall be determined based on monthly fixed remuneration, while taking into consideration his/her position, responsibilities, the level of other companies, and the Company's business performance, as well as taking into account the Company's overall performance.

- Matters concerning the determination of the details of remuneration, etc. of individual directors

The Chairman of the Board of Directors shall be authorized to delegate the specific details of the amount of remuneration for each individual director based on a resolution of the Board of Directors, and the details of such delegation shall be the amount of base remuneration for each director. To ensure that such authority is properly exercised by the Chairman of the Board of Directors, the Chairman of the Board of Directors shall consult with the Directors and the Nomination and Remuneration Committee, and shall determine the amount of compensation for each individual with respect to such consultation. The number of shares of restricted stock (stock-based compensation) to be allocated (granted) to each individual shall be determined by a resolution of the Board of Directors.

In order to strengthen the independence, objectivity, and accountability of the Board of Directors' functions related to the nomination and compensation of senior management and directors, the Company's Board of Directors established a Nomination and Remuneration Committee as an advisory body to the Board of Directors. The committee consists of three members, a representative director and two outside directors, and is chaired by the representative director. In addition, the independence of the committee is ensured by having a majority of the committee members be independent outside directors. Such committee shall deliberate on matters relating to the election and dismissal of directors and officers, as well as policies and procedures necessary to determine directors' remuneration, etc., and shall provide advice and recommendations to the Board of Directors.

As of March 31,2025

|

Executive Classification |

Total amount of compensation, etc. (millions of yen) |

Total amount of remuneration, etc. by type (millions of yen) |

Number of officers covered (persons) |

||

|

Basic remuneration |

Restricted stock compensation |

Non-monetary compensation, etc., of the left |

|||

|

Directors (excluding outside directors) |

116 |

116 |

- |

- |

5 |

|

Audit & Supervisory Board members (excluding outside Board members) |

12 |

12 |

- |

- |

1 |

|

Outside Directors |

31 |

31 |

- |

- |

7 |

- In addition to the above, one director (excluding outside directors) was paid 29,400 thousand yen as total compensation from a subsidiary of the Company.

- The above restricted stock compensation is the amount recorded as expenses for the current fiscal year.

The Compliance Committee has been established as a body to ensure compliance. The committee is composed of the director in charge, the general manager, the general manager of the Internal Audit, the full-time statutory auditor, the representative directors of subsidiaries, etc., and meets whenever necessary. This committee reports and discusses the status of internal reporting and compliance activities.

Each operating company has designated a compliance manager. The head office of the committee conducts a hearing once a month with the person in charge of compliance, and conducts periodic checks, including reminders to ensure that no action has been omitted. In addition, when a compliance-related problem arises, it must be reported to JESHD's Compliance Committee on the same day, rather than waiting for periodic confirmation, and a system has been established whereby JESHD and the operating companies can work together to quickly resolve the problem.

In addition, a regular meeting is held once a month at the JESHD head office to share information on compliance issues. The Compliance Committee also meets as needed and provides a forum for the exchange of information on compliance matters by bringing together managers from JESHD and all operating companies.

The JES Group has established an anti-corruption policy. Directors and employees are committed to conducting their business activities ethically. We will not tolerate bribery or corruption in any form and will comply with applicable laws prohibiting bribery and corruption ("anti-corruption laws").

Violations of anti-corruption laws can have serious consequences, including large fines, imprisonment or jail time, loss of public trust, and business losses.

We will require third parties who work for us, such as agents, consultants, advisors, distributors, suppliers, and contractors, to act in compliance with anti-corruption laws at all times.

The JES Group has a tax policy. The tax redistribution function is an essential part of society in all countries and regions, and tax reporting and payment in accordance with each country's tax system are regarded as important issues to be considered. We not only understand and comply with international frameworks such as the OECD Transfer Pricing Guidelines and the BEPS Action Plan, as well as all applicable tax laws and regulations in each country and region, and file tax returns and pay taxes appropriately, but also ensure that our employees are aware of these laws and regulations to prevent any violations from occurring. At the same time, we are building a risk management system by identifying and appropriately handling tax risks.

Supplier management is a key element across procurement, the procurement chain, and business processes as processes and activities that enable companies and organizations to effectively manage supplier relationships and achieve optimal value and results. In selecting suppliers, the JES Group strives to select the most appropriate cooperative organization, taking into consideration factors such as quality, price, delivery time, and reliability. We manage risk with respect to potential risks to our business with customers, including supplier financial health and supply risk. At the same time, we are building friendly relationships with our suppliers and collaborating to grow together, including technical assistance. We will promote increased competitiveness by strengthening relationships with suppliers in terms of efficiency, risk management, and quality improvement.

To prevent information leaks and security incidents, we are continuously working to strengthen our information management and operational systems. We are committed to continuous operation by taking measures not only against external attacks (cyber attacks, malware, ransom attacks, etc.), but also against information leaks from within.

We have established and are operating an Information Security Policy. Regarding the system and members related to information security, we have established and are operating a system based on the following rules.

The Chief Information Security Officer shall be appointed as the person in charge of information security in the Company.

The Chief Information Security Officer shall be the General Manager of the General Affairs Headquarters.

To assist the Chief Information Security Officer, an Information Security Officer shall be appointed at the Company and each subsidiary.

The information security officer shall be the general manager and the representative director of each subsidiary.

The Company shall establish an Information Security Committee. The Committee shall formulate policies, check compliance with the policies, investigate areas for improvement, and update the policies, as well as conduct educational and awareness-raising activities.

Information Security" is composed of the following members

(1) Chairperson: Chief Information Security Officer

(2) Committee members: Information security officers and others with expertise in information security

The Information Security Committee meets regularly.

The Information Security Committee reports on recent security trends, formulates countermeasures, disseminates them internally, and alerts employees to them.

In addition, the Company has taken steps to prevent information leaks by establishing rules for operating laptop computers and cell phones in the event that they are lost or stolen, as well as rules for operating such computers in the unlikely event that they become infected with a virus.

We have formulated the "Information Security Policy" as rules and guidelines for information security, and are implementing the policy by making it known to all employees.

Training is provided to all employees on the handling of personal information and IT security.

Whenever we receive important IT security information, such as the spread of malware worldwide, we alert all employees and inform them of the importance of IT security.

As part of our efforts to protect personal information, we have formulated and are operating "Rules for the Protection of Personal Information and Specified Personal Information". Specifically, we have established and are operating a system to explain in advance how personal information is used and how it is provided to third parties, and to ensure that information is properly managed.

Combined measures are in place to deal with cyber-attacks from outside. Specifically, we have established and are operating a complex of system security measures such as "installation of firewalls" and "installation of anti-virus software" as well as "measures to improve individual IT literacy (do not access suspicious websites, do not open unknown emails)". In addition, IT asset management software is installed on all terminals, and a mechanism is in place to detect unauthorized actions and operations.

In order to prevent information leakage due to unauthorized access, important files stored on our file server are encrypted and managed. In addition, we have established a mechanism to check access to external sites using computer access logs and firewall logs in case information leakage is suspected.

We have established rules for the protection of personal information and specified personal information to appropriately protect personal information, personal numbers, and other specified personal information handled by the company in the course of conducting its business, to prevent leaks, and to use such information in an appropriate manner. When the management of personal information, etc., is entrusted to a third party, we require the entrusted third party to comply as well.

We conduct research and development, including price and duration, in order to offer numerous options to our clients. We also aim to create products that are flexible to the common practices of the elevator industry and offer appropriate proposals.

We will do this as part of our business growth, mainly in research and development, so that intellectual property can be protected and effectively utilized.

A management department has been established in the Development Division to compile information on R&D, related products, and related companies to obtain intellectual property rights.

The JES Group recognizes the importance of intellectual property rights and strives to comply with all relevant laws and regulations, respects the intellectual property of others, and ensures the preservation and appropriate management of its own intellectual property.

Through further investment in intellectual property and intangible assets, we will accelerate our technological innovation and enhance our corporate value over the medium to long term.